How to switch back to personal account: A comprehensive guide

Switching back to a personal account is the process of changing a business account back to a personal account. This can be done for a variety of reasons, such as if you no longer need the business account or if you want to consolidate your accounts. The process of switching back to a personal account is relatively simple, but there are a few things you need to keep in mind.

Switching back to a personal account can be beneficial for a number of reasons. For example, it can help you to simplify your finances and reduce your monthly expenses. Additionally, it can give you more control over your account and make it easier to manage your money.

Read also:Mikayla Campinos The Rising Star Of Social Media

The process of switching back to a personal account has evolved over time. In the past, it was a more complex and time-consuming process. However, thanks to advances in technology, it is now much easier to switch back to a personal account.

In this article, we will provide you with a step-by-step guide on how to switch back to a personal account. We will also provide you with some tips on how to make the process as smooth as possible.

How to switch back to personal account

When switching back to a personal account, there are several key aspects to consider. These include:

- Reasons for switching: Determine why you need to switch back to a personal account.

- Account consolidation: Consider consolidating your accounts to simplify your finances.

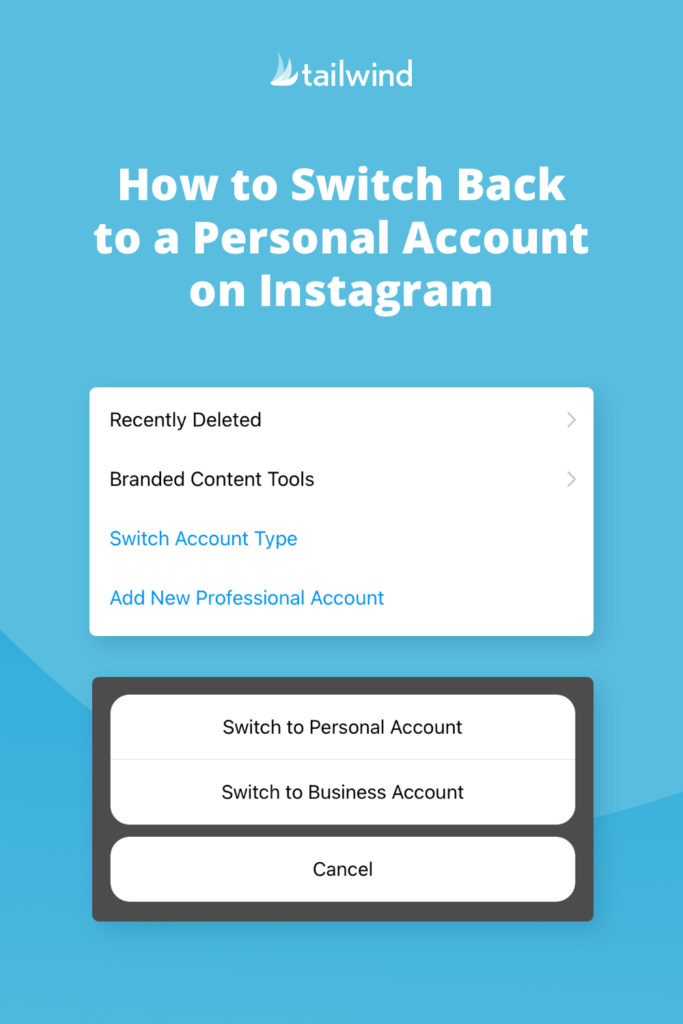

- Process involved: Understand the steps involved in switching back to a personal account.

- Impact on finances: Consider the potential impact on your finances.

- Timeline for switching: Estimate the time it will take to complete the switch.

These aspects are all interconnected and should be considered together when making the decision to switch back to a personal account. For example, the reasons for switching will impact the process involved and the timeline for switching. Additionally, the impact on finances should be carefully considered to ensure that you are making the best decision for your financial situation.

Overall, switching back to a personal account can be a beneficial move for many people. By considering the key aspects discussed above, you can make an informed decision and ensure that the process goes smoothly.

Reasons for switching

Understanding the reasons for switching back to a personal account is a critical component of the process. It helps you to determine the best course of action and ensures that you are making the right decision for your financial situation.

Read also:Hugh Jackmans Wife Age Biography And Relationship Insights

There are many reasons why someone might need to switch back to a personal account. Some of the most common reasons include:

- No longer need the business account: If you no longer have a business, or if your business is no longer active, you may no longer need a business account. Switching back to a personal account can simplify your finances and reduce your monthly expenses.

- Consolidate accounts: You may want to consolidate your accounts to make it easier to manage your finances. Switching back to a personal account can allow you to do this, as you can combine your business and personal finances into a single account.

- Simplify finances: Switching back to a personal account can simplify your finances and make it easier to track your spending. This can be especially beneficial if you are not very familiar with business accounting.

Once you have determined the reasons for switching back to a personal account, you can begin the process. The process of switching back to a personal account is relatively simple, but there are a few things you need to keep in mind. You will need to:

- Contact your bank: You will need to contact your bank and let them know that you want to switch back to a personal account. They will be able to provide you with the necessary paperwork and instructions.

- Close your business account: Once you have completed the paperwork, you will need to close your business account. This can be done by withdrawing all of the money from the account and then closing it with the bank.

- Open a personal account: Once your business account is closed, you can open a personal account. You can do this by visiting your bank or by applying online.

Account consolidation

Account consolidation is the process of combining multiple financial accounts into a single account. This can be done for a variety of reasons, such as to simplify your finances, reduce your monthly expenses, and get a better overview of your financial situation.

Consolidating your accounts can be a critical component of switching back to a personal account. By combining your business and personal accounts into a single account, you can simplify your finances and make it easier to track your spending. This can be especially beneficial if you are not very familiar with business accounting.

There are many real-life examples of how account consolidation can be used to simplify finances. For example, a small business owner might consolidate their business and personal accounts into a single account to make it easier to track their expenses and income. This can help them to better manage their finances and make informed decisions about their business.

Account consolidation can also be used to reduce monthly expenses. For example, a person with multiple credit cards might consolidate their balances into a single credit card with a lower interest rate. This can help them to save money on interest charges and pay off their debt faster.

Understanding the connection between account consolidation and switching back to a personal account is important for making informed financial decisions. By consolidating your accounts, you can simplify your finances, reduce your monthly expenses, and get a better overview of your financial situation. This can make it easier to switch back to a personal account and manage your finances more effectively.

Process involved

Understanding the process involved in switching back to a personal account is a critical component of the overall process. It helps you to avoid potential pitfalls and ensures that you are able to switch back to a personal account successfully.

The process of switching back to a personal account can vary depending on your bank and your specific circumstances. However, there are some general steps that you will need to follow, such as:

- Contact your bank: The first step is to contact your bank and let them know that you want to switch back to a personal account. They will be able to provide you with the necessary paperwork and instructions.

- Close your business account: Once you have completed the paperwork, you will need to close your business account. This can be done by withdrawing all of the money from the account and then closing it with the bank.

- Open a personal account: Once your business account is closed, you can open a personal account. You can do this by visiting your bank or by applying online.

By following these steps, you can switch back to a personal account and simplify your finances. However, it is important to understand the process involved and to be prepared for any potential challenges.

One real-life example of the process involved in switching back to a personal account is the case of a small business owner who decided to close their business and return to working as an employee. In order to do this, they needed to switch their business account back to a personal account. They contacted their bank and followed the steps outlined above. The process was relatively simple and straightforward, and they were able to switch back to a personal account without any problems.

Understanding the process involved in switching back to a personal account is important for a number of reasons. First, it helps you to avoid potential pitfalls. For example, if you do not close your business account properly, you may be charged unnecessary fees. Second, it helps you to ensure that you are able to switch back to a personal account successfully. By following the steps outlined above, you can make the process as smooth and easy as possible.

Impact on finances

When switching back to a personal account, it is important to consider the potential impact on your finances. There are a number of factors that can affect your finances, such as:

- Account fees: Personal accounts may have different fees than business accounts. For example, personal accounts may have monthly maintenance fees or transaction fees. It is important to compare the fees of different accounts before switching.

- Interest rates: Personal accounts may have different interest rates than business accounts. If you are switching to a personal account with a lower interest rate, you may earn less interest on your savings.

- Credit score: Closing a business account can have a negative impact on your credit score. This is because business accounts are typically considered to be more stable than personal accounts. If you have a high credit score, it is important to consider the potential impact of closing your business account.

- Taxes: Switching to a personal account may have tax implications. For example, if you are using your personal account for business purposes, you may need to pay taxes on your business income.

It is important to weigh the potential benefits and drawbacks of switching back to a personal account before making a decision. By considering the impact on your finances, you can make an informed decision that is right for you.

Timeline for switching

When switching back to a personal account, it is important to consider the timeline for switching. This is the amount of time it will take to complete the process of switching back to a personal account. There are a number of factors that can affect the timeline for switching, such as:

- Bank processing time: The time it takes for your bank to process your request to switch back to a personal account can vary. Some banks may be able to process your request within a few days, while others may take several weeks.

- Account closure: If you are closing your business account as part of the process of switching back to a personal account, this can also add to the timeline. You will need to withdraw all of the money from your business account and then close the account with the bank. This process can take several days or even weeks, depending on your bank's policies.

- Account opening: Once you have closed your business account, you will need to open a personal account. This process can typically be completed within a few days, but it may take longer if you need to provide additional documentation to the bank.

- Transfer of funds: Once you have opened a personal account, you will need to transfer any funds from your business account to your personal account. This process can take a few days, depending on the amount of money you are transferring and the method of transfer.

Overall, the timeline for switching back to a personal account can vary depending on a number of factors. However, by understanding the factors that can affect the timeline, you can plan accordingly and make the process as smooth as possible.

Frequently Asked Questions

This FAQ section aims to provide answers to some of the most common questions and concerns regarding switching back to a personal account. These questions address various aspects of the process, potential implications, and helpful tips.

Question 1: What are the key steps involved in switching back to a personal account?

To switch back to a personal account, you typically need to contact your bank, close your business account, and open a personal account. The specific steps and requirements may vary depending on your bank and individual circumstances.

Question 2: Can I switch back to a personal account if my business is still active?

Usually, you cannot switch back to a personal account while your business is still operating. You need to close your business account and dissolve your business entity before you can open a personal account.

Question 3: What happens to my funds when I close my business account?

When you close your business account, you will need to withdraw or transfer all the funds to another account, such as your personal account. It's important to note that any outstanding business expenses or liabilities should be settled before closing the account.

Question 4: Will switching back to a personal account affect my credit score?

Closing a business account may have a slight impact on your credit score, as business accounts are often viewed as more stable than personal accounts. However, the impact should be minimal, especially if you have a good credit history.

Question 5: Can I keep my business name when I switch to a personal account?

Typically, you cannot use your business name for your personal account, as it may lead to confusion and potential legal issues. You will need to choose a different name for your personal account.

Question 6: What are some tips for making the switch back to a personal account as smooth as possible?

To ensure a smooth transition, plan ahead, gather all necessary documentation, communicate with your bank promptly, and consider consolidating your accounts to simplify your finances.

These FAQs provide a general overview of the process and considerations involved in switching back to a personal account. For specific advice tailored to your situation, it's recommended to consult with your bank or a financial advisor.

Now that we have covered the frequently asked questions, let's delve into the potential benefits and drawbacks of switching back to a personal account to help you make an informed decision.

Tips for Switching Back to a Personal Account

This section provides practical tips to help you navigate the process of switching back to a personal account. By following these recommendations, you can ensure a smoother transition and avoid potential pitfalls.

Tip 1: Plan Ahead: Start the process early to allow sufficient time for account closures, transfers, and any necessary documentation.

Tip 2: Gather Documentation: Collect all relevant documents, such as business registration, tax ID, and bank statements, to facilitate the account closure and opening process.

Tip 3: Communicate with Your Bank: Inform your bank of your intention to switch back to a personal account. They will guide you through the necessary steps and provide assistance.

Tip 4: Close Business Accounts Properly: Ensure that all outstanding transactions are settled and funds are transferred before closing your business accounts.

Tip 5: Consolidate Accounts: Consider consolidating your business and personal finances into a single personal account to simplify management and reduce fees.

Tip 6: Review Account Fees and Interest Rates: Compare different personal accounts to find one with favorable fees and interest rates that meet your needs.

Tip 7: Consider Tax Implications: Be aware of any potential tax implications wynikajce from switching to a personal account for business purposes.

Tip 8: Monitor Your Credit: Closing a business account may slightly impact your credit score. Monitor your credit report to ensure that the change is reflected accurately.

Following these tips can help you transition back to a personal account efficiently and minimize any disruptions to your financial management. By planning ahead and seeking professional advice when needed, you can navigate this process with confidence.

In the final section of this article, we will explore strategies for managing your personal finances effectively after switching back to a personal account.

Conclusion

Switching back to a personal account can be a strategic move for simplifying your finances and aligning your accounts with your current business and financial needs. By understanding the process, considering the impact on your finances, and following the tips outlined in this article, you can navigate this transition smoothly.

Key points to remember:

- Plan ahead and gather necessary documentation to facilitate the account closure and opening process.

- Communicate with your bank and follow their instructions to ensure a seamless switch.

- Consolidate your accounts and review fees and interest rates to optimize your financial management.

Remember, effective personal finance management is an ongoing process. By staying organized, monitoring your accounts, and seeking professional advice when needed, you can maintain financial stability and achieve your financial goals.